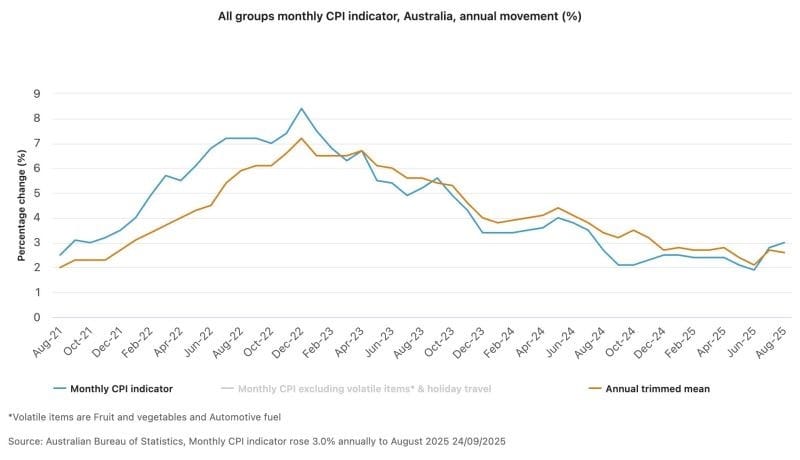

Hopes of a near-term rate cut have dimmed, after the Australian Bureau of Statistics’ monthly consumer price index rose 3% in the year to August, up from 2.9% in July. That’s its highest level in a year.

The main culprit? Electricity. Power prices jumped 25% over the year, as state rebates in Queensland, Western Australia and Tasmania ended. Housing costs also rose 4.5%, while food and drinks were up 3%.

But there was some good news in the finer detail. The trimmed mean measure of inflation, which strips out volatile movements, actually edged down from 2.7% to 2.6%.

That means inflation is technically still within the Reserve Bank of Australia’s (RBA) 2% to 3% target range. Still, with headline inflation rising and household spending proving stubborn, the RBA is widely expected to hold rates steady at its September 29-30 meeting.

Anthony Landahl | Managing Director Equilibria Finance

This is for general information purposes only and does not constitute advice. With all of these options there are a number of considerations outside the scope of what is covered in this article that you need to understand to ensure your personal circumstances are taken into consideration.

Equilibria Finance is a mortgage broking practice specialising in delivering residential and commercial mortgage and business and asset finance solutions to the clients of financial advice and accounting practices.